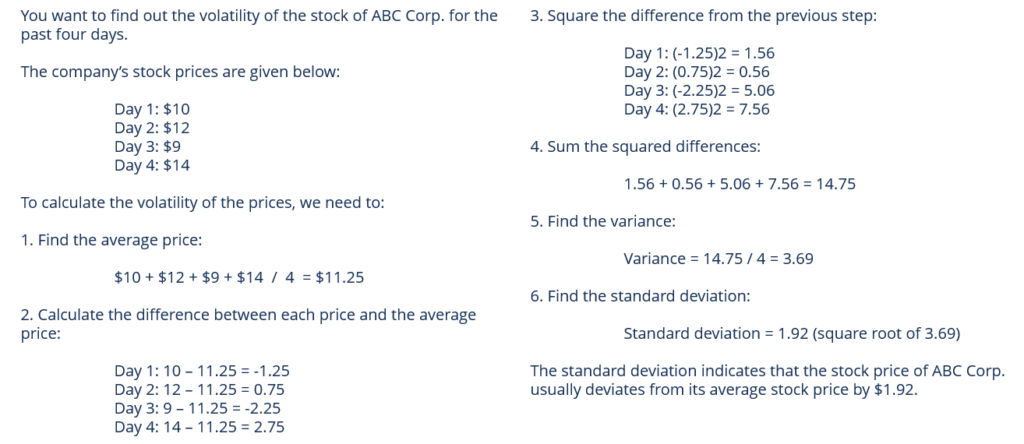

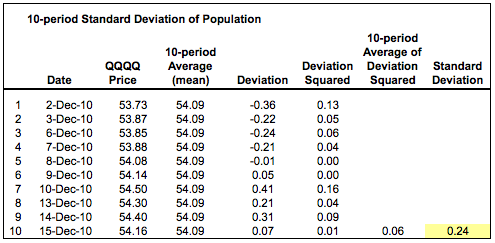

Volatility is inherently related to standard deviation or the degree to which prices differ from their mean. The formula for daily volatility is computed by finding out the square root of the variance of a daily stock price.

Implied Volatility To Discover Stock Price Expectations Option Party

In our example 1 73 times the square root of 252 is 27 4.

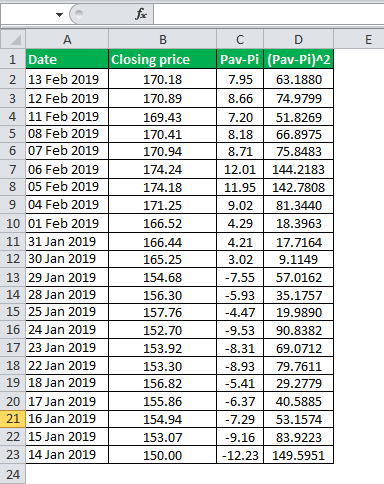

Price volatility formula. Annualized volatility is calculated using the formula given below. Because this measure of price volatility is in terms of dollar price change dividing the price value of a basis point by the initial price gives the percentage price change for a 1 basis point change in yield. Therefore the formula in cell c3 will be.

To calculate volatility you ll need to figure a stock s standard deviation which is a measure of how widely stock prices are spread around their average value. The prices you will use to calculate volatility are the closing prices of the stock at the ends of your chosen periods. Price volatility is the same for an increase or a decrease of 1 basis point in required yield.

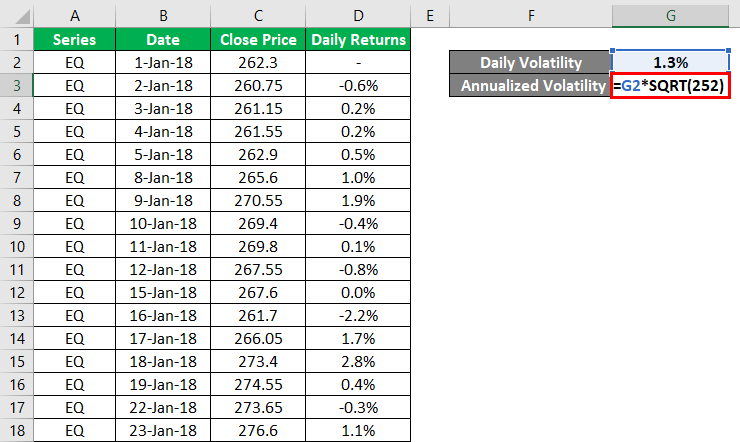

The formula for square root in excel is sqrt. For example for daily periods these would be the closing price on that day. Annualized volatility standard deviation 252.

Volatility is a measure of the speed and extent of stock prices changes. 252 are the number of days in a. Unlike the usual way people look at prices of securities and their changes up or down the volatility point of view does not care about the direction so much.

In cell c13 enter the formula stdev s c3 c12 to compute the standard deviation. Therefore based on the daily price movements in august 2015 the s p 500 s annualized. Traders use volatility for a number of purposes such as figuring out the price to pay for an option contract on a stock.

Yield value of a price change. Daily volatility formula is represented as daily volatility formula variance further the annualized volatility formula is calculated by multiplying the daily volatility by a square root of 252. Volatility is a measure of how much something tends to change.

Ln b3 b2 where cell b3 is the current day s closing price and cell b2 the previous day s closing price. In our case the x is the ratio of closing prices. Market data can be found and in some cases downloaded from market tracking websites like yahoo.

Now that she knows the standard deviation she finishes the calculation to find price volatility by multiplying the standard deviation times the square root of 252.

Historical Volatility Hv Overview How To Calculate

Historical Volatility Hv Overview How To Calculate

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

Standard Deviation Volatility Chartschool

Standard Deviation Volatility Chartschool

Volatility Calculation Historical Varsity By Zerodha

How Do You Calculate Volatility In Excel

The Options Industry Council Oic Volatility The Greeks

The Options Industry Council Oic Volatility The Greeks

0 comments:

Post a Comment