P e stock price per share earnings per share. The market price of an ordinary share of a company is 50.

Price earnings ratio formula.

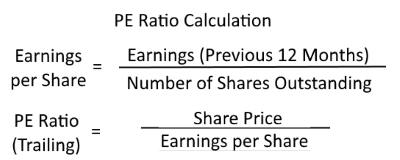

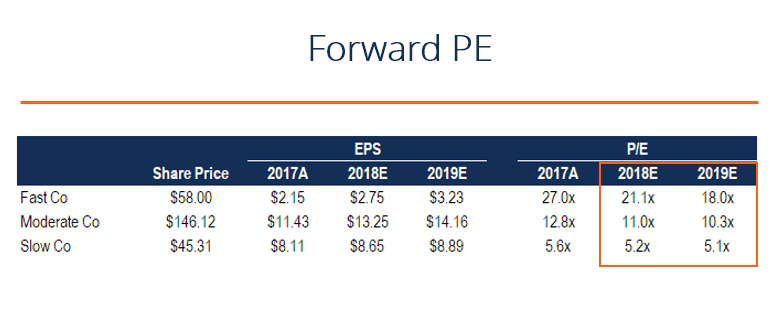

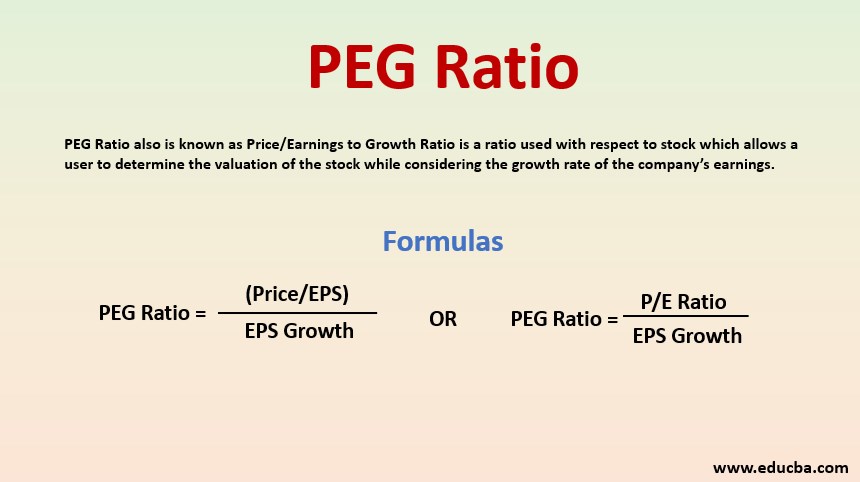

Price earnings ratio formula example. The price earnings to growth peg ratio is a company s stock price to earnings ratio divided by the growth rate of its earnings for a specified time period. Compute price earnings ratio. G sustainable growth rate.

As long as a company has positive earnings the p e ratio can be calculated. Mathematically it is represented as below price to earnings ratio share price earnings per share example of price to earnings ratio with excel template. Ratio dfrac 23 10 3 14 7 36 in this example assume a fictional bank has shares valued at 23 10 while the earnings per share sat at 3 14.

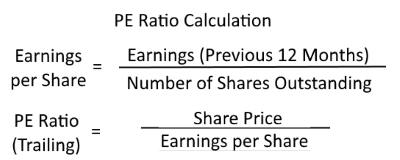

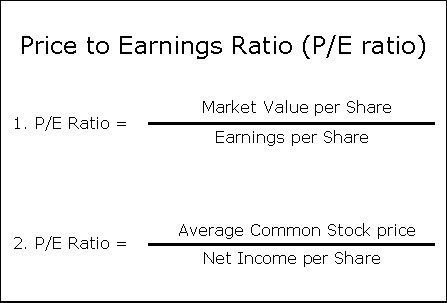

Eps represents the e in p e ratio where eps earnings total shares outstanding. P e ratio formula explanation. P e market capitalization total net earnings.

This ratio can be calculated at the end of each quarter when quarterly financial statements are issued. It means the earnings per share of the company is covered 10 times by the market price of its share. R required rate of return.

For example a price to earnings ratio of 10 means that the company has 1 of annual per share earnings for every 10 in share price. Earnings by definition are after all taxes etc. Justified p e dividend payout ratio r g.

The trailing p e ratio is calculated by dividing current stock price current period earnings per share. The price earnings ratio of the company is 10. While price earnings ratio is most often calculated using the formula discussed above there are different variants of the ratio and the calculation may differ depending on the point of reference.

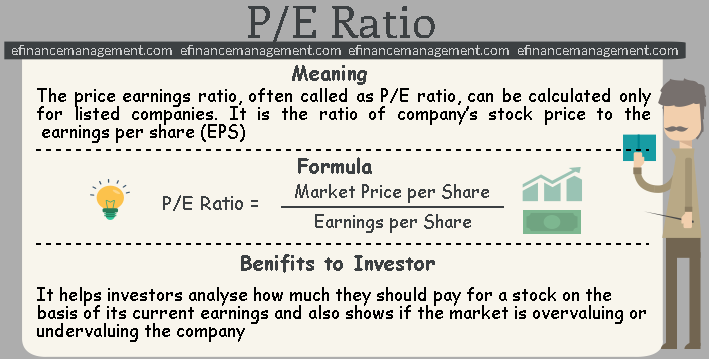

The formula for the p e ratio is expressed as the share price or market value of the subject company divided by its earnings per share. What is the p e ratio. 50 5 10.

The earnings per share is 5. More taking stock of overvalued stocks. The price earnings ratio formula is calculated by dividing the market value price per share by the earnings per share.

In other words 1 of earnings has a market value of 10. Price earnings p e ratio 56 2 8 20 times the p e ratio of the company is 5 36 which means that the market price of an ordinary share of the john trading concern is 20 times higher than the earnings per share for the period of last 12 months. The price earnings ratio or p e ratio measures a company s share price as compares with its per share earnings.

Price to earnings ratio example p e.

Pe Ratio 16 Easy Steps To Price Earnings Ratio Mastery Liberated Stock Trader Learn Stock Market Investing

Pe Ratio 16 Easy Steps To Price Earnings Ratio Mastery Liberated Stock Trader Learn Stock Market Investing

Forward P E Ratio Example Formula And Downloadable Template

Forward P E Ratio Example Formula And Downloadable Template

Pe Ratio Price To Earnings Definition Formula And More

Pe Ratio Price To Earnings Definition Formula And More

Pe Ratio In Stocks Formula Example Calculate Price Earning Ratio Youtube

Pe Ratio In Stocks Formula Example Calculate Price Earning Ratio Youtube

Pe Ratio How It Helps You Make Better Investment Decisions Sgmoneymatters

Pe Ratio How It Helps You Make Better Investment Decisions Sgmoneymatters

Using Price Earnings Ratio To Calculate The Share Price Youtube

Using Price Earnings Ratio To Calculate The Share Price Youtube

Forward Pe Ratio Formula Examples Excel Calculation Youtube

Forward Pe Ratio Formula Examples Excel Calculation Youtube

Peg Ratio Example Explanation With Excel Template

Peg Ratio Example Explanation With Excel Template

Decoding The Pe Ratio Of A Stock The Calm Investor

Decoding The Pe Ratio Of A Stock The Calm Investor

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

P E Ratio Meaning Valuation Formula Calculation Analysis More

P E Ratio Meaning Valuation Formula Calculation Analysis More

0 comments:

Post a Comment