Market value per share. You calculate a trailing p e by using earnings per share from the last four quarters or 12 months of earnings.

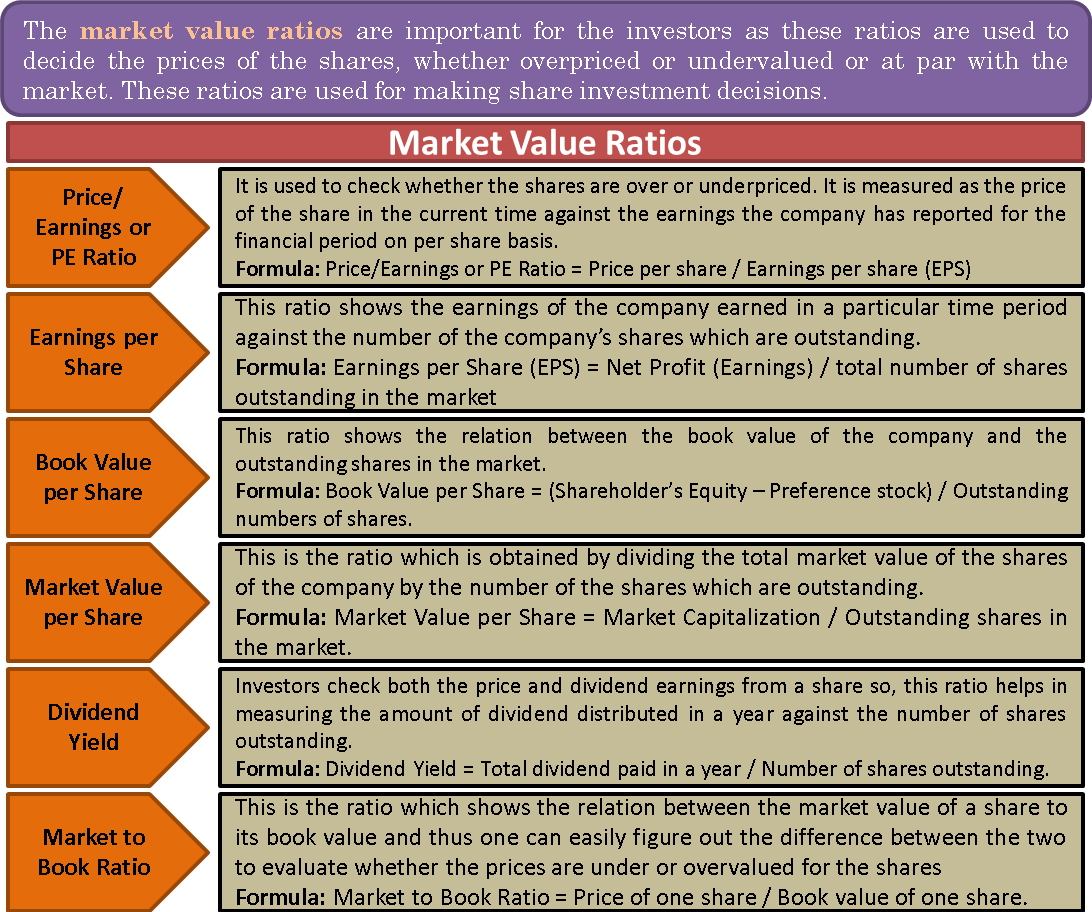

Market Value Ratios Calculation And Formulas Of Market Value Ratios

Market Value Ratios Calculation And Formulas Of Market Value Ratios

Eps is found by taking earnings from the last twelve months divided by the weighted average shares outstanding.

Current market price per share formula. There are a number of price per share formulas used for stocks depending on the type and time of investment. Market value per share. The market value per share is simply the going price of the stock.

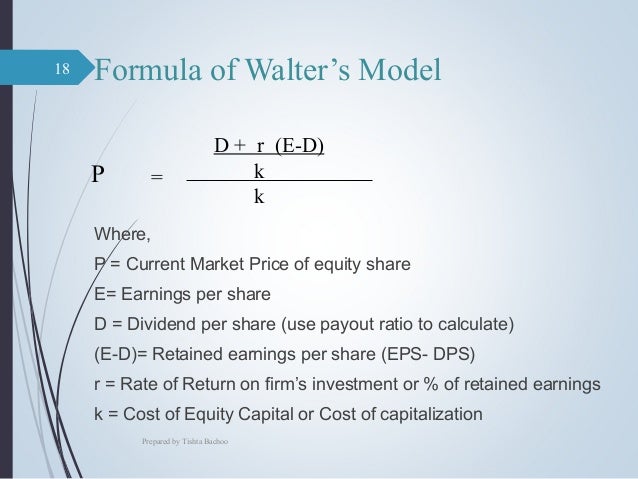

This reveals the value that the market currently assigns to each share of a company s stock. Trailing current and forward earnings. Current price of stock s 1 g 100 r g 100 where s current dividend per share r required rate of return g stock growth rate.

The market price per share formula says this is equal to the total value of the company divided by the number of shares. The market price per share is used to determine a company s market capitalization or market cap to calculate it take the most recent share price of a company and multiply it by the total number of outstanding shares. The current market price or market value per share of common stock is always the last price at which shares were sold.

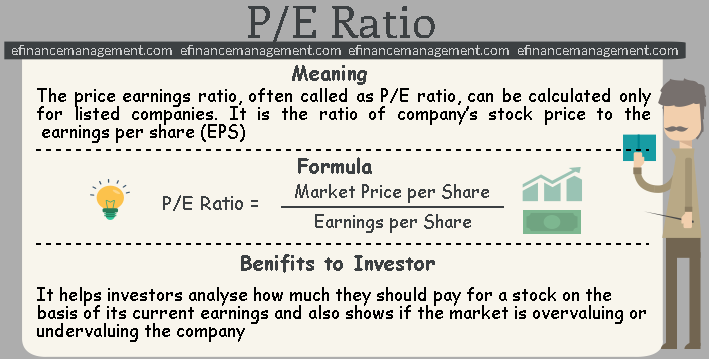

The price to earnings ratio p e ratio is the ratio for valuing a company that measures its current share price relative to its per share earnings. The average price per share is calculated by dividing the total amount paid for shares by the number of shares bought. 4 this is a simple way of calculating how valuable a company is to traders at that moment.

P e ratio formula explanation the basic p e formula takes the current stock price and eps to find the current p e. The p e formula comes in three flavors which vary according to how earnings per share is calculated. Calculated as the total market value of the business divided by the total number of shares outstanding.

To calculate this market value ratio divide the price per share by the earnings per share. This price varies throughout the day based on the level of demand for the stock. Market value per share is the price at which a share of company stock can be acquired in the marketplace such as on a stock exchange.

This number gives you a view of a company s earnings ratios based on. Strictly speaking market prices aren t calculated. What is price to earnings ratio p e ratio.

Other common calculations include the average issue price per share of preferred stock and the market price per share.

How To Calculate Future Expected Stock Price The Motley Fool

How To Calculate Future Expected Stock Price The Motley Fool

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg) Using Price To Book Ratio To Evaluate Companies

Using Price To Book Ratio To Evaluate Companies

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

Earnings Per Share Formula Examples How To Calculate Eps

Earnings Per Share Formula Examples How To Calculate Eps

How Is Market Price Per Share Calculated Quora

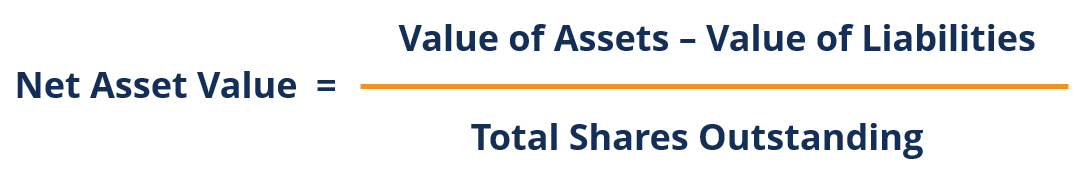

Net Asset Value Definition Formula And How To Interpret

Net Asset Value Definition Formula And How To Interpret

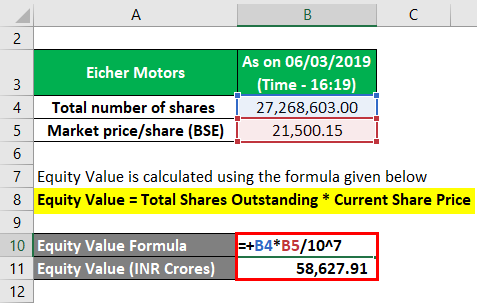

Equity Value Formula Calculator Excel Template

Equity Value Formula Calculator Excel Template

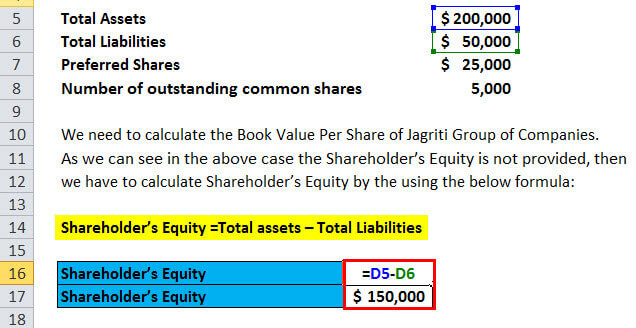

Book Value Per Share Formula Calculator Excel Template

Book Value Per Share Formula Calculator Excel Template

P E Ratio Meaning Valuation Formula Calculation Analysis More

P E Ratio Meaning Valuation Formula Calculation Analysis More

0 comments:

Post a Comment